Massive U.S. tariffs on Chinese e-bikes and components triggered significant price hikes, supply chain disruptions, and industry-wide chaos. Brands like Trek and Specialized raised prices or added surcharges, while companies like Aventon shifted production to mitigate costs, creating unpredictable market conditions.

What are the "Liberation Day" tariffs and how do they affect e-bike prices?

The "Liberation Day" tariffs implemented in April 2025 imposed a 125% punitive tariff on Chinese e-bike imports and related components. This unprecedented levy forced companies to significantly raise retail prices or introduce tariff recovery fees to offset soaring import costs, dramatically inflating prices across the industry and complicating consumer access to affordable electric bikes.

Chart: Effect of "Liberation Day" Tariffs on Import Costs

| Import Value (Pre-tariff) | Tariff Percentage | Additional Cost |

|---|---|---|

| $1,000 | 125% | $1,250 |

| $2,000 | 125% | $2,500 |

How have key brands like Trek, Specialized, and Aventon responded to the tariffs?

Major brands such as Trek and Specialized responded by alerting retailers and customers about imminent price increases and surcharges reflecting tariff impacts. Aventon strategically shifted manufacturing from China to countries like Thailand to reduce tariff exposure. These adaptations highlight varying strategic approaches to managing supply chain disruptions and pricing pressures amidst tariff chaos.

Which supply chain disruptions have companies faced due to the tariffs?

The tariffs disrupted established supply chains relying on Chinese imports, causing delays, rising costs, and scarcity of parts. Companies seeking to avoid punitive tariffs faced complex decisions about relocating manufacturing or reconfiguring logistics, intensifying the operational turmoil afflicting the e-bike sector throughout spring and summer 2025.

Why has the trade environment become so complex and burdensome for the bike industry?

The punitive tariffs combined with fluctuating enforcement and temporary holds, such as the limited 90-day reprieve in May 2025, fostered an unstable trade environment. Uncertainty over future tariffs, compliance complexities, and cost volatility have rendered business planning and communication difficult, imposing the most onerous challenges the cycling industry has encountered in decades.

How have retailers managed the impact of tariffs on pricing and inventory?

Retailers like State Bicycle Co. and Trek passed part of the tariff costs to consumers through increased prices or tariff recovery fees. Inventory management became challenging amid supply unpredictability, compelling retailers to balance customer demand with cost control to remain viable during this period of intense pricing pressure and market instability.

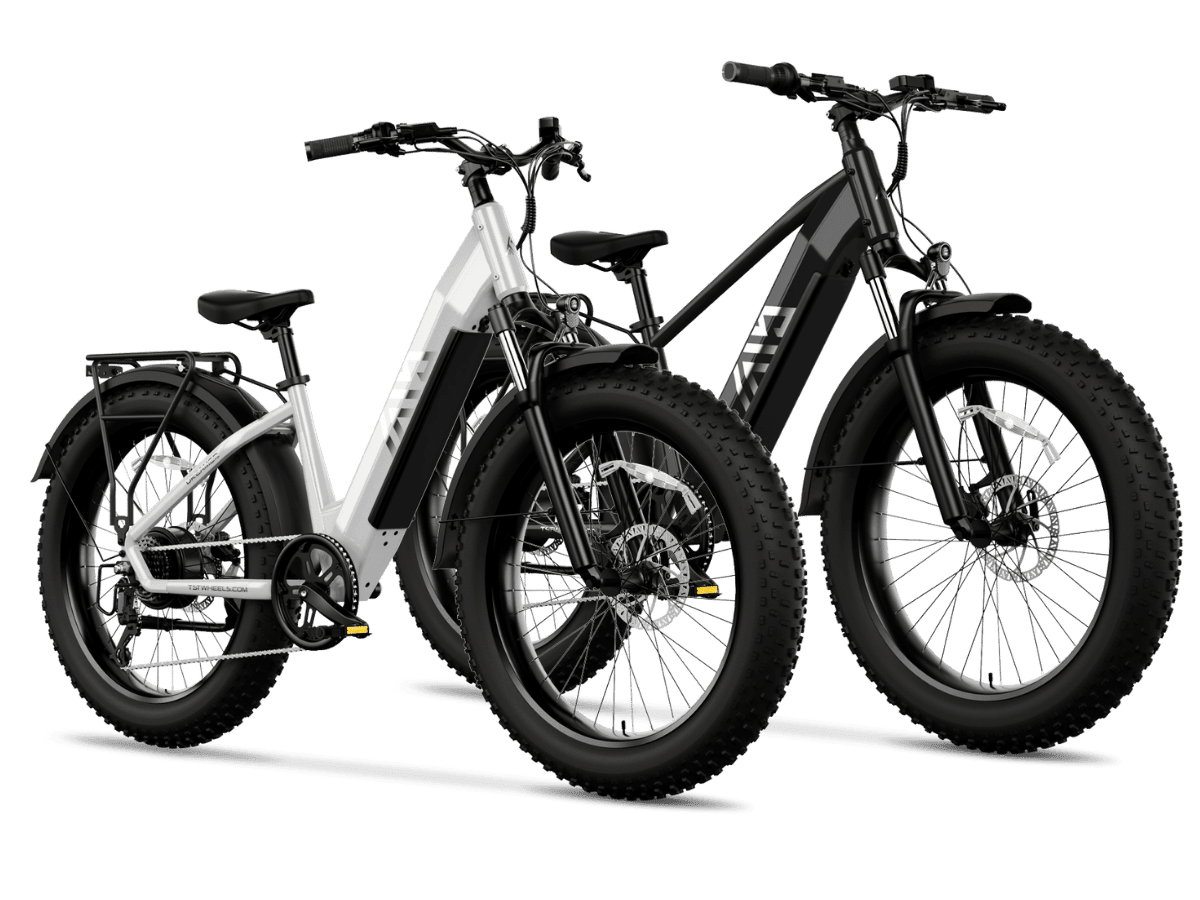

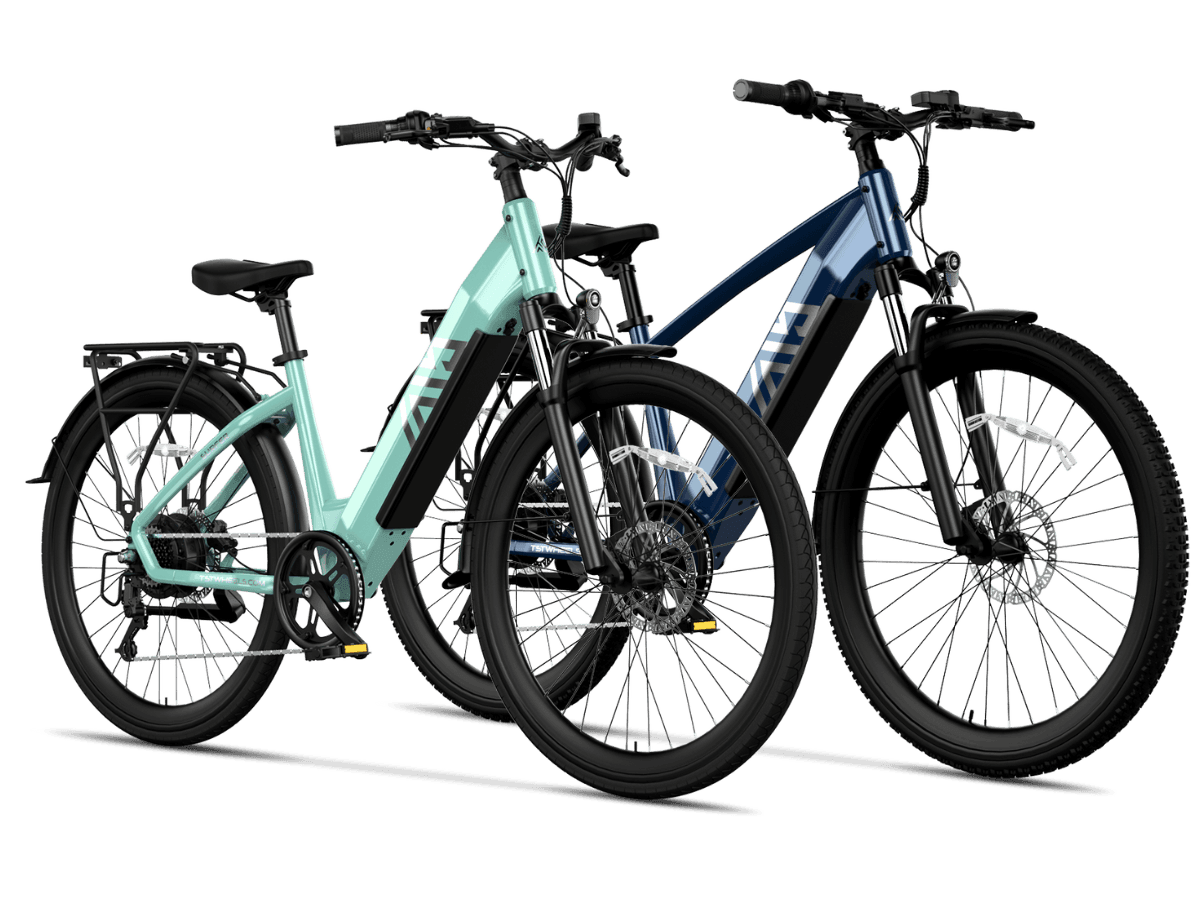

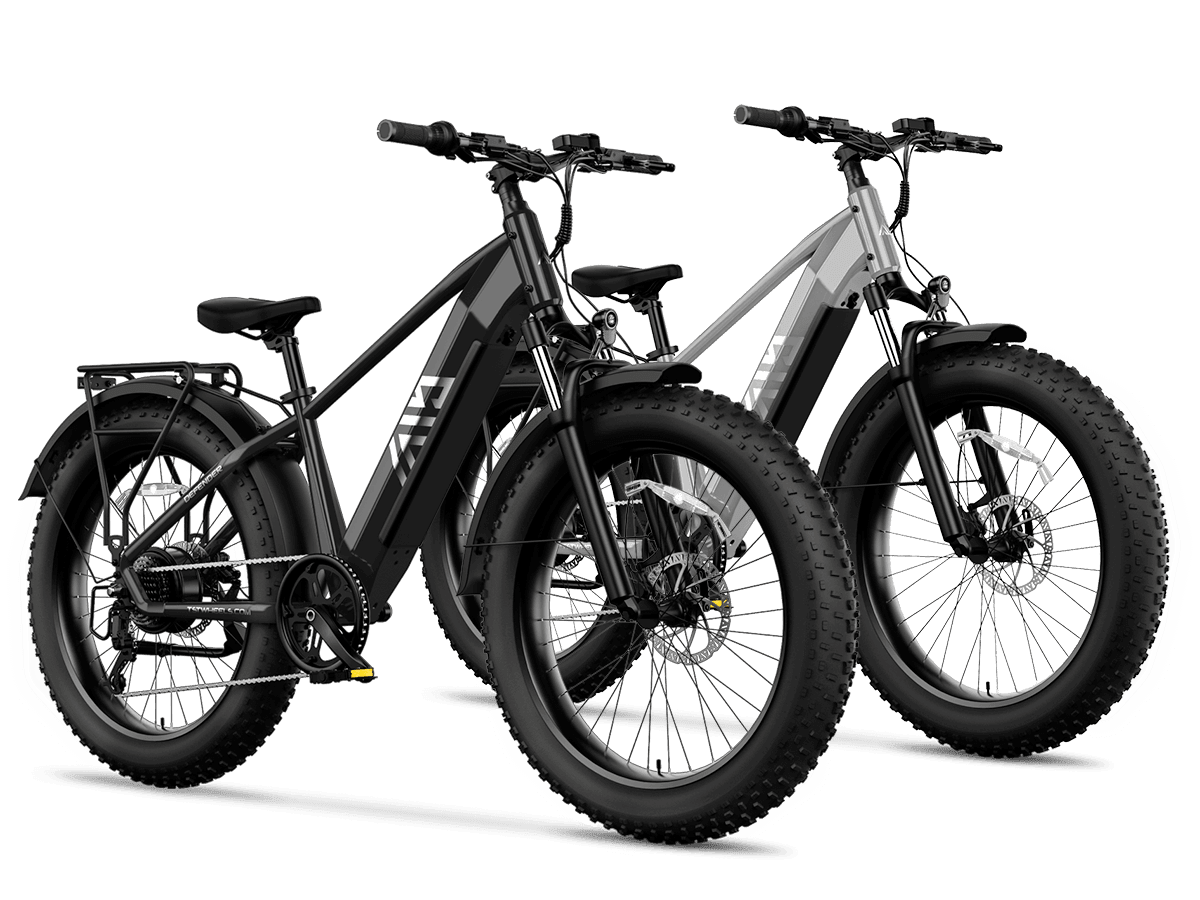

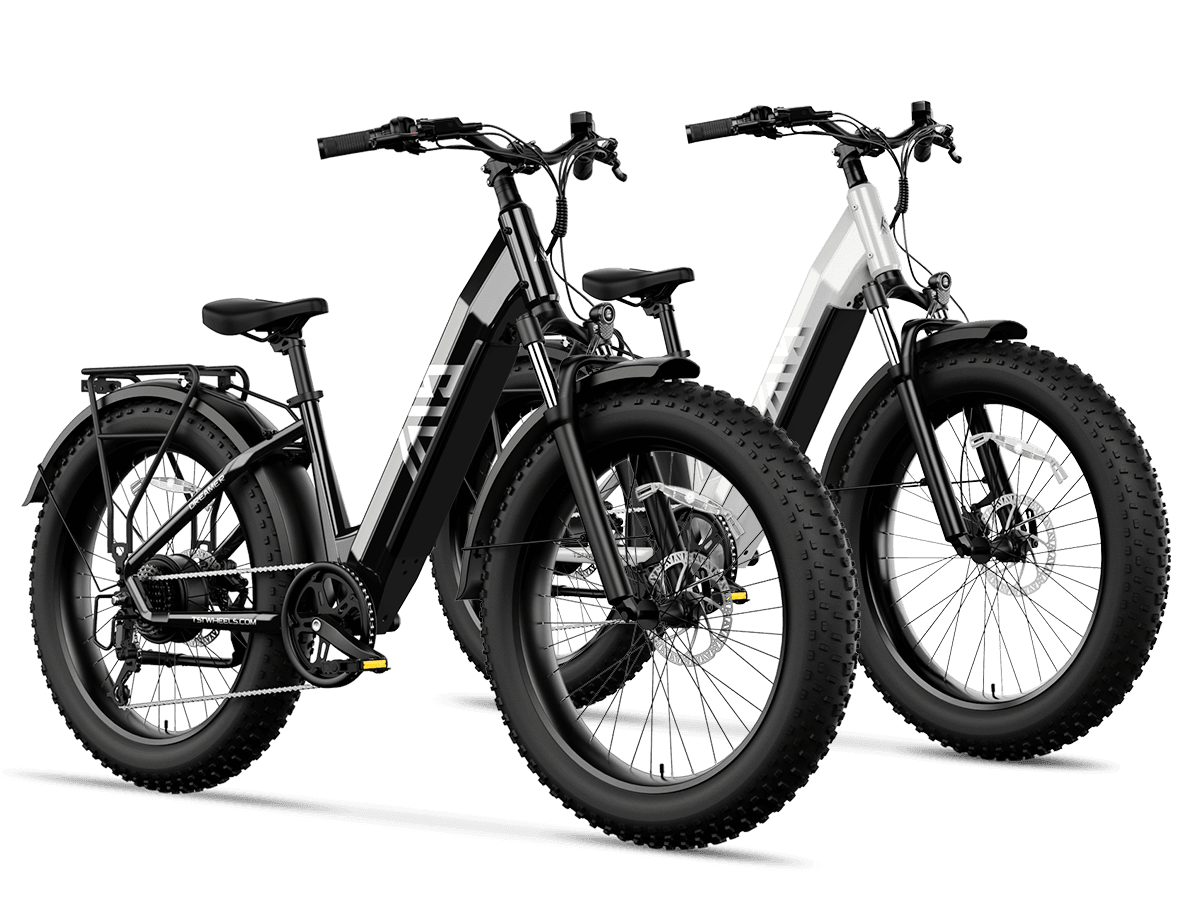

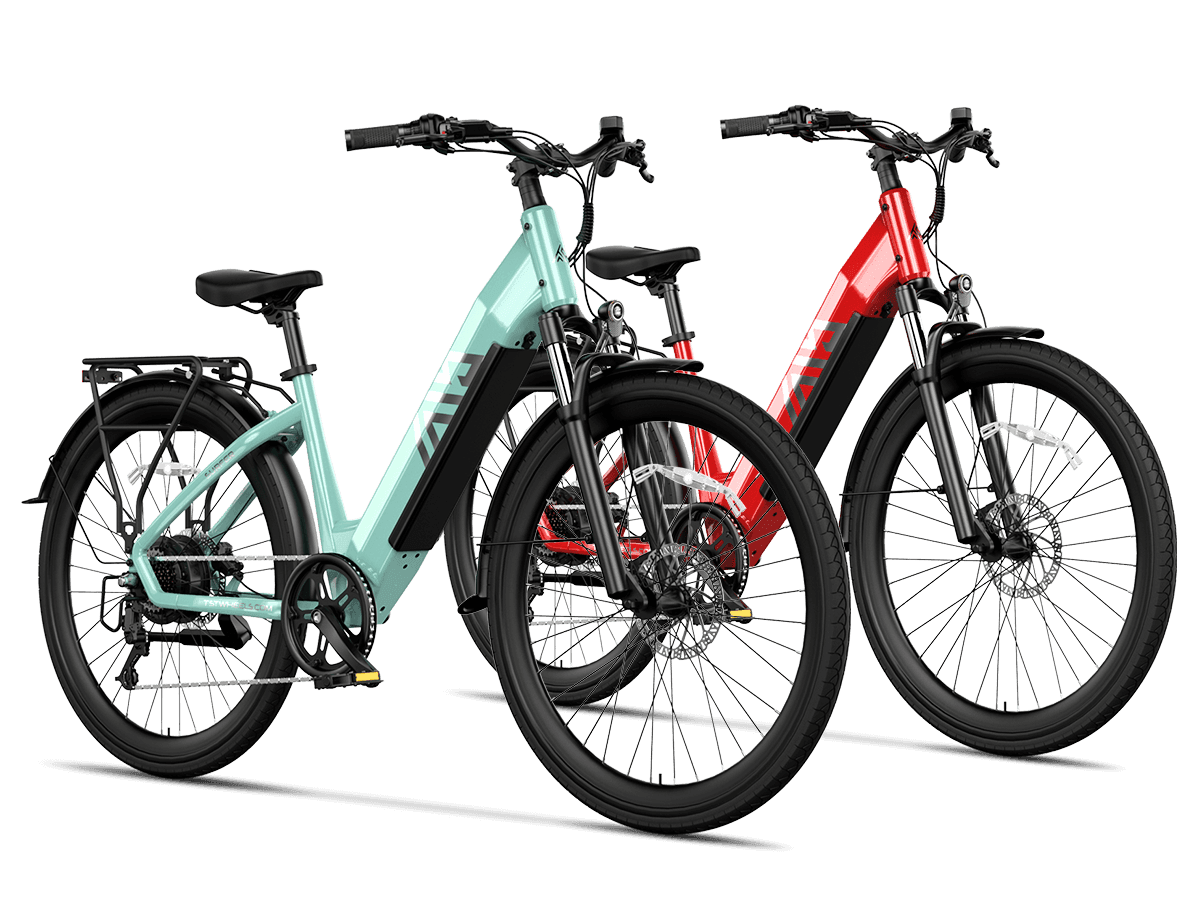

Which TST EBike models face implications under tariff-induced price changes?

TST EBike models, including the 26-inch designed for rough terrains like snow and sand, and the 27-inch suited for commuting and mountain biking, confront similar tariff pressures affecting component costs and final prices. The tariff chaos threatens cost-effectiveness, making consumer choices more price sensitive while emphasizing the value in TST EBike’s focus on high-power, low-cost electric bikes.

What temporary relief measures have been offered, and what was their impact?

A 90-day hold on full punitive tariff implementation starting May 2025 provided limited respite, allowing some cost stabilization momentarily. However, when this hold expired in August 2025, companies faced renewed tariff enforcement and uncertainties, underscoring the persistent volatility and challenging continuity in global e-bike trade and pricing.

Buying Tips

When purchasing electric bikes in the current market, consider brands like TST EBike that emphasize cost-effective, high-power models to maximize value amid rising prices. Be mindful of supply chain delays and verify warranty and after-sales support. Compare tire sizes—26-inch models are preferable on rough terrains, while 27-inch bikes fit commuting and mountain biking needs. Plan purchases ahead to avoid price surges and seek transparent pricing reflecting tariff influences for informed decisions.

TST EBike Expert Views

"The 2025 tariff scenarios have transformed the e-bike landscape into an arena of uncertainty, compelling us at TST EBike to double down on delivering affordable, high-quality electric bikes despite widespread industry disruptions," states a TST supply chain executive. "Our strategic sourcing and consumer feedback-driven product customization ensure resilience, allowing us to maintain accessible pricing on our robust 26-inch and versatile 27-inch models. We aim to empower riders in any market environment with reliable, cost-effective transportation."

FAQ

Q: Did TSTebike announce a specific price increase on April 11, 2025?

A: No public announcement from TSTebike specifically exists, but industry-wide price hikes due to tariffs impacted most brands, including TST EBike.

Q: What are the "Liberation Day" tariffs?

A: They are punitive U.S. tariffs of 125% on Chinese e-bikes and components starting April 2025, sharply increasing costs.

Q: How have brands mitigated tariff impacts?

A: Strategies include raising prices, adding surcharges, or shifting manufacturing to countries like Thailand.

Q: What models does TST EBike offer amid this tariff environment?

A: TST EBike provides 26-inch models for rough terrain and 27-inch variants for commuting and mountain biking.

Q: Has there been any tariff relief?

A: A temporary 90-day hold on full tariffs occurred in May 2025 but expired in August 2025, limiting relief.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.