Ebike incentives in 2025 include federal tax credits, state rebates, and local programs that reduce the cost of electric bicycles by up to 30% or $1,500. These incentives encourage sustainable transportation, making high-quality electric bikes more affordable for commuters and recreational riders alike.

What Federal Ebike Incentives Are Available in 2025?

The proposed US E-BIKE Act offers a refundable federal tax credit of 30% of the purchase price of a qualifying electric bicycle, capped at $1,500. To qualify, the ebike must cost less than $8,000, have a motor under 750 watts, be classified as Class 1, 2, or 3, and meet UL 2849 safety certification. This credit can be claimed once every three years per individual, or twice for joint filers, with income phase-outs starting at $75,000 for singles and $150,000 for joint filers.

Chart: Key Requirements for Federal Ebike Tax Credit

| Requirement | Details |

|---|---|

| Max Credit | 30% of purchase price, up to $1,500 |

| Price Cap | Less than $8,000 |

| Motor Power | Under 750 watts |

| Ebike Class | Class 1, 2, or 3 |

| Certification | UL 2849 required |

| Income Phase-Out | $75,000 single, $150,000 joint |

Which State and Local Ebike Incentives Can You Access?

Many states and cities offer direct incentives or tax savings for electric bike purchases. Popular programs include point-of-sale vouchers that give instant discounts at the register and rebates you claim after buying. California provides up to $2,000 in rebates for qualified buyers, while Colorado offers $400–$500 incentives. Florida exempts ebikes from sales tax. Oregon, Vermont, and Pennsylvania have extra grants, often for income-eligible residents. Localities may provide extra rebates or tax credits, so always check regional websites for updated details.

Many US states offer additional ebike incentives that complement federal credits. These include cash rebates, sales tax exemptions, and point-of-sale discounts. Examples include:

- California: Up to $2,000 rebate for income-qualified residents plus $250 for disadvantaged communities.

- Colorado: \$400 rebate for standard ebikes, \$500 for cargo ebikes.

- Florida: Sales tax exemption on ebike purchases.

- Washington, D.C.: Up to $2,000 voucher for low-income residents buying cargo ebikes.

Eligibility criteria vary by state and may include residency, income limits, and purchase from authorized dealers.

How Do Ebike Incentives Work in Canada and Europe?

In Canada, provinces like British Columbia, Nova Scotia, Prince Edward Island, and Yukon offer rebates ranging from $500 to $750 for ebike purchases, often limited to residents and businesses buying from approved retailers. European countries such as Austria provide subsidies covering up to 50% of the ebike purchase price, with caps around €800 to €1,000, supporting private individuals and organizations to promote green transport.

Why Should You Consider Ebike Incentives When Buying?

Ebike incentives significantly lower upfront costs, making electric bicycles more accessible. They encourage eco-friendly commuting, reduce traffic congestion, and improve air quality. By leveraging these incentives, buyers can afford higher-quality ebikes like those from TST EBike, which offers cost-effective, high-power models suited for various terrains and uses.

Chart: Example Savings from Ebike Incentives

| Purchase Price | Federal Tax Credit (30%) | State Rebate (Example) | Total Savings | Final Cost |

|---|---|---|---|---|

| $2,500 | $750 | $400 | $1,150 | $1,350 |

| $4,000 | $1,200 | $500 | $1,700 | $2,300 |

How Do TST EBike Models Align with Incentive Programs?

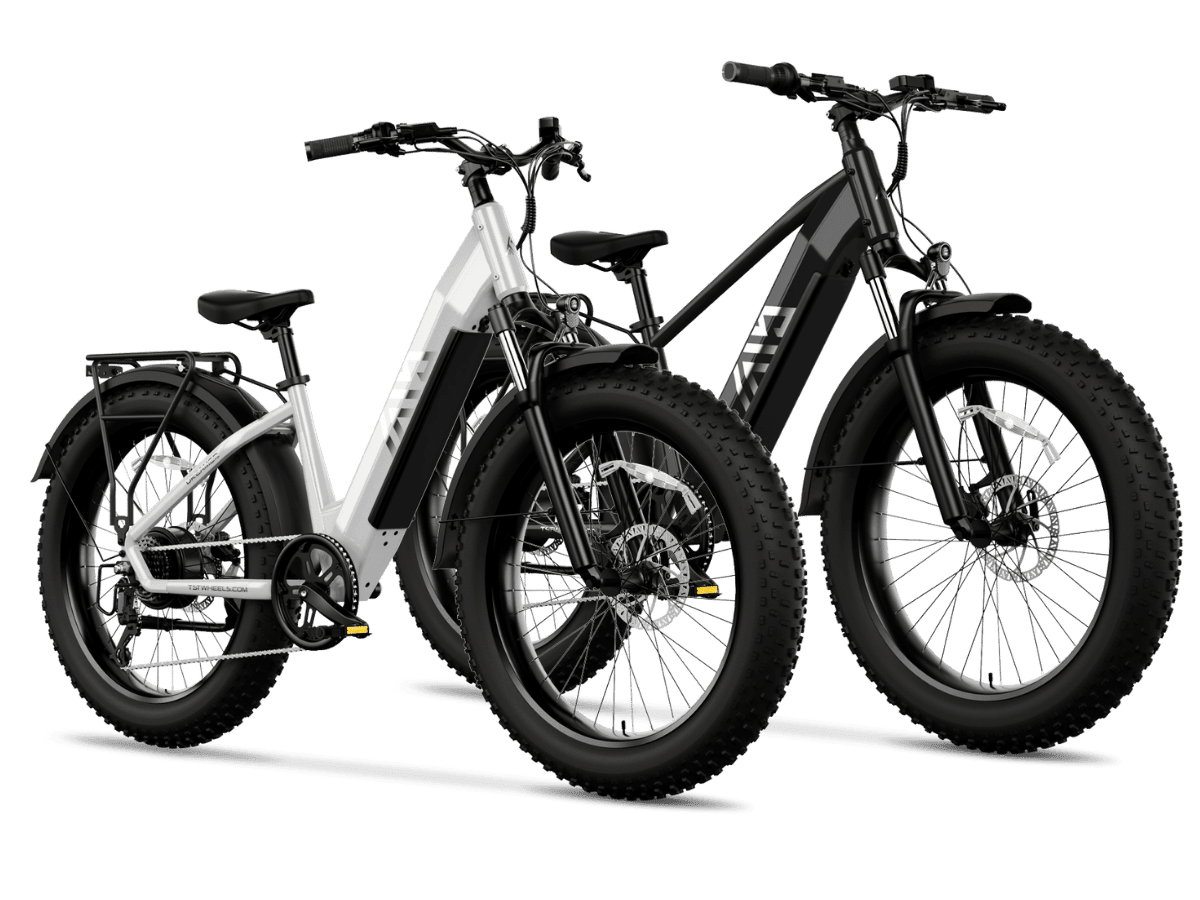

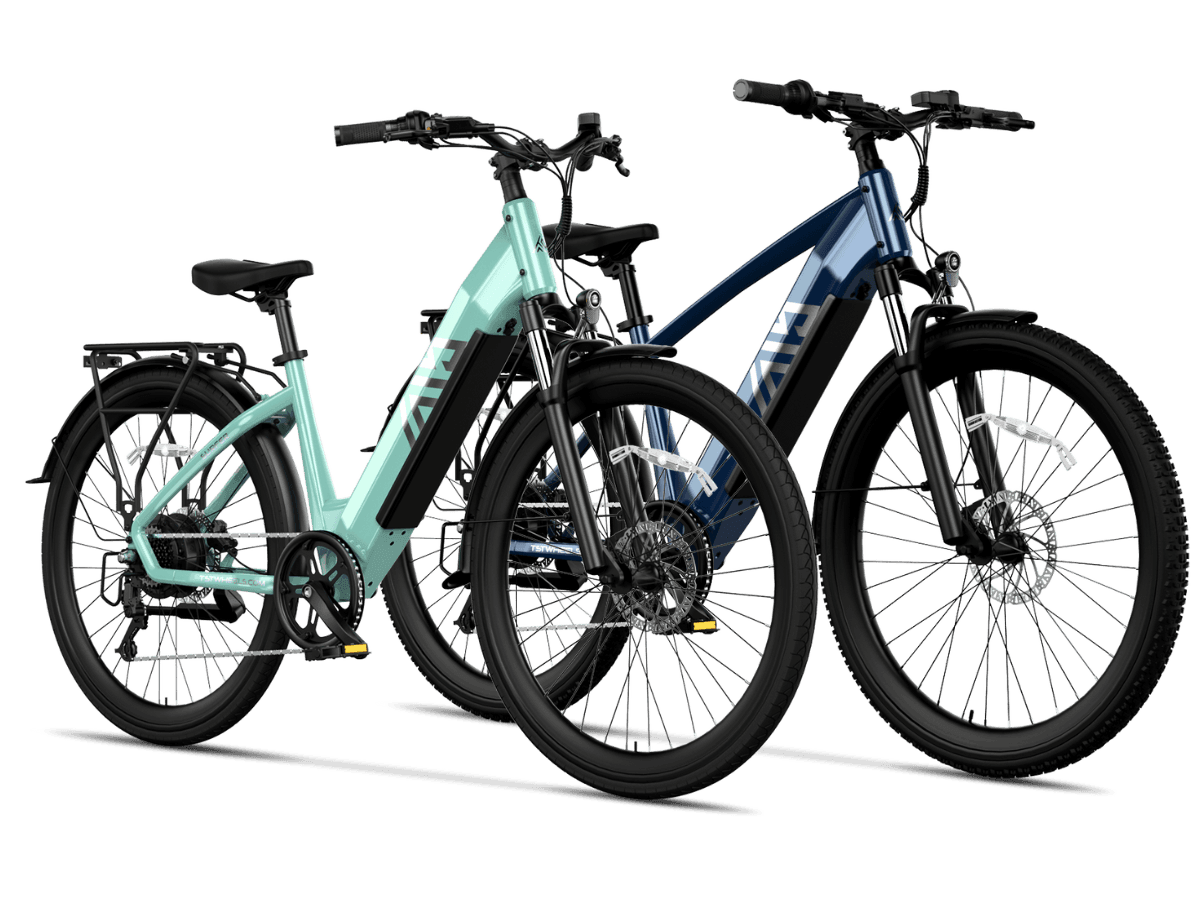

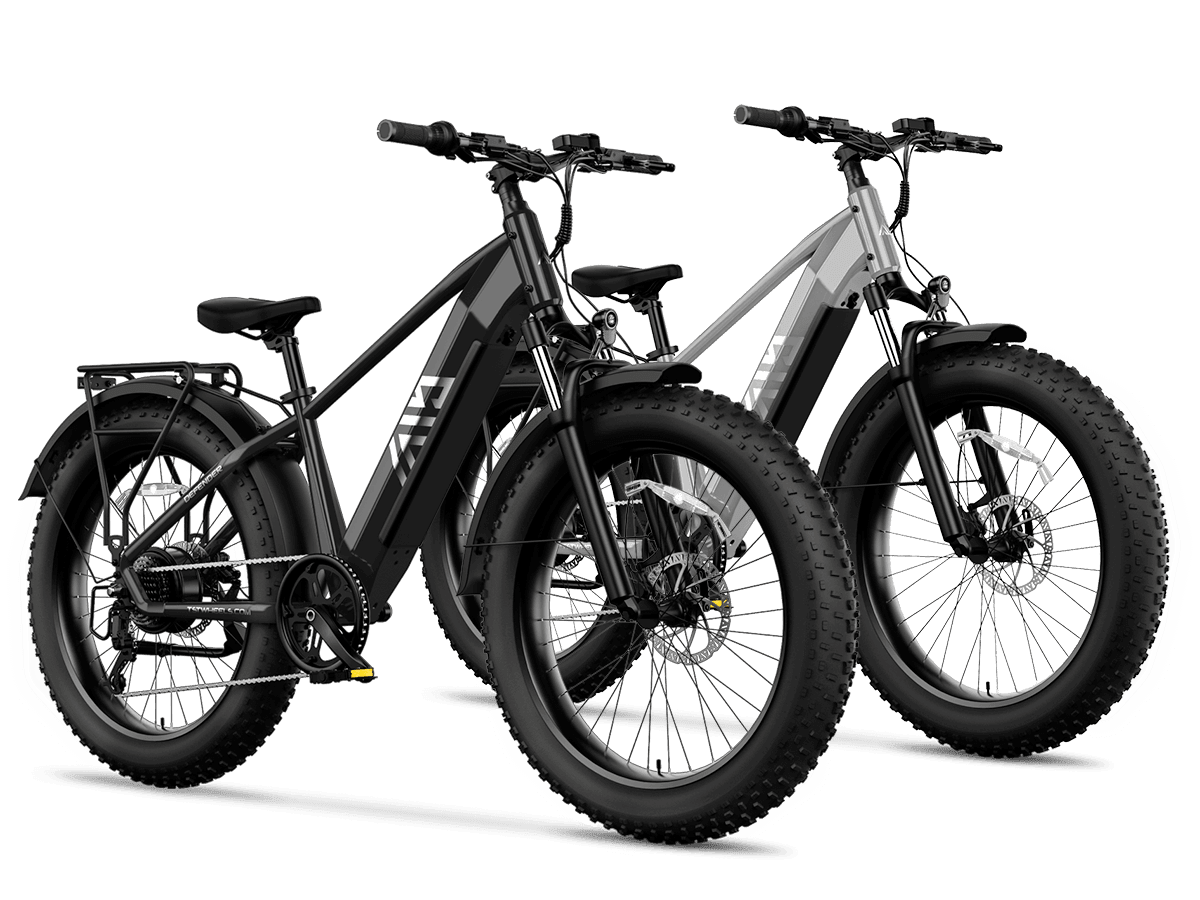

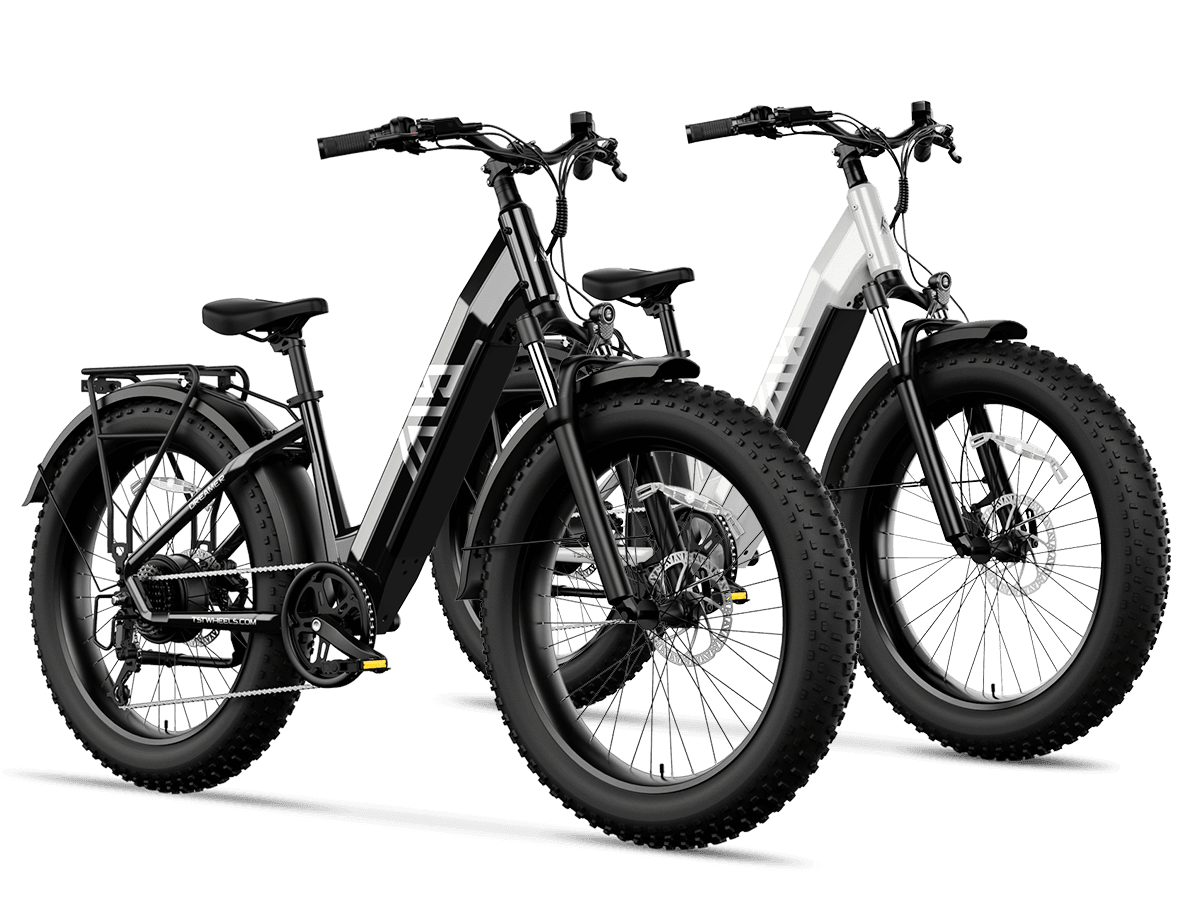

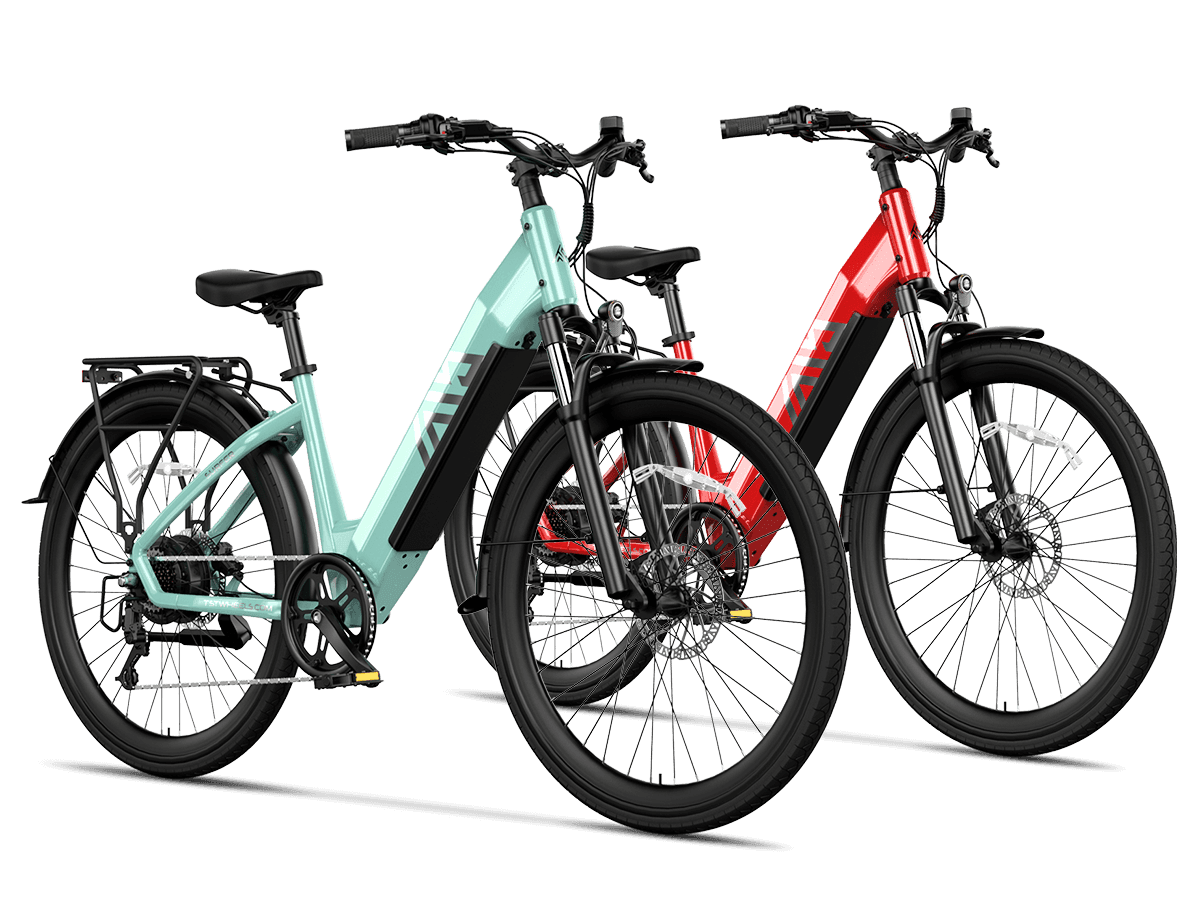

TST EBike offers 26-inch models ideal for rough terrains like snow and sand and 27-inch models perfect for daily commuting and mountain biking. These models typically meet the motor power and classification requirements to qualify for most federal and state incentives, ensuring buyers can maximize savings while enjoying high-quality electric bikes.

Buying Tips

When purchasing an electric bike, consider the following:

- Verify eligibility for federal and state incentives to maximize savings.

- Choose a model that fits your terrain and commuting needs—TST EBike’s 26-inch is great for rough terrain; 27-inch suits city and mountain rides.

- Confirm the bike meets UL 2849 certification and motor power limits under 750 watts.

- Buy from authorized dealers to qualify for point-of-sale rebates.

- Check income and residency requirements for rebates and tax credits.

- Factor in warranty, battery life, and after-sales service.

These steps ensure you get the best value and compliance with incentive programs.

TST EBike Expert Views

“TST EBike is committed to providing affordable, high-performance electric bicycles that meet the evolving needs of riders,” says a TST EBike specialist. “Our models are designed to qualify for the latest incentive programs, allowing customers to benefit from significant savings. Whether navigating rough terrains with our 26-inch bikes or commuting daily on our 27-inch models, riders can enjoy quality and value supported by these incentives.” This reflects TST EBike’s dedication to consumer-focused innovation and sustainability.

FAQ About Ebike Incentives

Q: Can I combine federal and state ebike incentives?

A: Yes, most state rebates and tax credits stack with the federal tax credit, increasing overall savings.

Q: How often can I claim the federal ebike tax credit?

A: Once every three years per individual; joint filers can claim twice in three years.

Q: Do all ebikes qualify for incentives?

A: No, ebikes must meet criteria including motor power under 750 watts, Class 1-3 classification, and UL 2849 certification.

Q: Are ebike incentives available outside the US?

A: Yes, countries like Canada and Austria offer rebates and subsidies for electric bicycles.

Q: Does TST EBike offer models that qualify for incentives?

A: Yes, TST EBike’s high-quality models meet most incentive program requirements.

What Are The Economic Benefits Of E-Bikes?

E-bikes reduce transportation costs by cutting fuel expenses, parking fees, and maintenance. They boost local economies by increasing access to jobs and retail. Health benefits from cycling reduce healthcare costs. Additionally, e-bikes lower urban congestion, saving time and productivity.

What Is The E-Bike Incentive Project?

The e-bike incentive project is a government or local program offering rebates, tax credits, or subsidies to encourage e-bike purchases. These incentives lower upfront costs, making e-bikes more accessible and promoting eco-friendly transportation and reduced emissions.

Why Are E-Bikes The Future?

E-bikes are the future due to their eco-friendly design, affordability, and ability to ease urban congestion. Advances in battery tech, wider adoption, and supportive policies make them practical alternatives to cars, promoting healthier lifestyles and sustainable cities.

Are E-Bike Sales Increasing?

Yes, e-bike sales are rapidly increasing worldwide. Rising fuel prices, environmental concerns, and improved technology drive growth. Markets in Europe, the USA, and Asia report double-digit annual sales growth, making e-bikes a significant segment in personal mobility.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.